Customer Experience Management in Finance: The Power of Document Generation Software

Enhance customer experience in finance with document generation software. Discover how automation transforms client engagement and operational efficiency.

In todays fast-paced digital landscape, customer expectations in the financial sector are higher than ever. Personalization, speed, and accuracy are now table stakes. To meet these demands, financial institutions are turning to document generation software as a core tool in their customer experience management (CEM) strategy.

This blog explores how document automation reshapes customer interactions in finance and empowers institutions to deliver more consistent, timely, and personalized experiences.

The Rising Importance of Customer Experience in Finance

Customer experience (CX) has become a key competitive differentiator in the finance industry. Whether its banking, insurance, investment management, or fintech, customers expect:

-

Fast onboarding

-

Transparent communications

-

Personalized financial advice

-

Immediate access to documents and services

A poor customer experiencedelayed statements, inaccurate reports, or confusing policy documentscan quickly lead to churn. In contrast, a streamlined, accurate, and branded experience builds loyalty and trust.

The Challenge: Legacy Systems and Manual Processes

Many financial institutions still rely on outdated systems and manual document handling processes. This results in:

-

Human error in document creation

-

Slow turnaround times

-

Inconsistent branding and messaging

-

Compliance risks due to outdated templates

These inefficiencies directly impact the customer experience. For example, a client waiting days for a mortgage approval letter or an insurance quote is more likely to seek alternatives.

Enter Document Generation Software

Document generation software automates the creation of business-critical documents such as:

-

Loan agreements

-

Insurance policies

-

Investment reports

-

Customer statements

-

Onboarding forms

These tools use predefined templates and integrate with CRM, ERP, and other back-end systems to pull in real-time data. The result is a fast, accurate, and consistent generation of customer-facing documents.

Benefits of Document Generation for Customer Experience Management

1. Speed and Efficiency

Automation drastically reduces the time it takes to create and deliver documents. What once took hours or days can now be accomplished in minutes, improving response times and overall customer satisfaction.

Example: A wealth management firm can instantly generate personalized investment reports for each client before a meeting, using up-to-date data pulled directly from its financial systems.

2. Personalization at Scale

Customers expect communications to be tailored to their individual needs and circumstances. Document generation tools can dynamically populate templates with specific customer information, allowing for mass personalization.

Example: Insurance providers can auto-generate quotes and policy documents tailored to the customer's coverage needs, demographics, and risk profilewithout manual intervention.

3. Brand Consistency and Professionalism

A cohesive and professional appearance is crucial in finance. Document generation tools ensure consistent branding, tone, and formatting across all customer communications, reducing the risk of off-brand or poorly formatted documents.

4. Improved Compliance and Reduced Risk

Compliance is non-negotiable in the financial industry. By using standardized templates and incorporating compliance logic into documents, organizations minimize the risk of regulatory violations.

Example: Banks can embed up-to-date legal clauses and terms into loan documents automatically, ensuring every customer receives legally compliant paperwork.

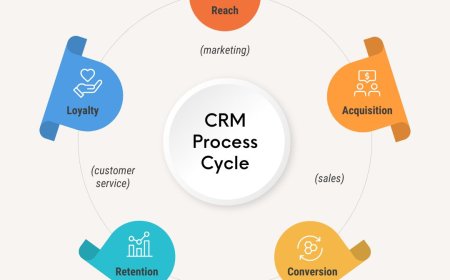

5. Seamless Integration with Customer Journeys

Document generation can be integrated into digital workflows across the customer lifecyclefrom onboarding to servicing to retention. This ensures a smooth, omnichannel experience.

Example: During onboarding, customers can receive personalized welcome letters, account disclosures, and regulatory documents instantly after submitting their application.

Use Cases in Financial Services

Retail Banking

-

Account opening confirmations

-

Loan approval letters

-

Monthly account statements

Insurance

-

Policy documentation

-

Renewal notices

-

Claims correspondence

Wealth and Investment Management

-

Portfolio performance reports

-

Investment policy statements

-

Quarterly summaries

Mortgage and Lending

-

Pre-approval letters

-

Loan agreements

-

Amortization schedules

Key Features to Look for in Document Generation Software

When selecting a document automation tool for financial services, consider the following:

-

Template Management: Ability to create, edit, and reuse templates with ease.

-

Data Integration: Seamless integration with core banking systems, CRMs (like Salesforce), and data lakes.

-

Conditional Logic: Allows documents to adapt content based on customer data or regulatory rules.

-

Multi-language Support: For global or multilingual customer bases.

-

Audit Trails and Version Control: Essential for compliance and internal review processes.

-

eSignature Integration: To complete document workflows without printing.

Transforming the Customer Experience Journey

Customer experience management is not just about having friendly service representatives or a sleek app interface. Its about delivering a seamless, responsive, and personalized journey at every touchpoint. Document generation software plays a foundational role by eliminating friction, delays, and inconsistencies.

Imagine a new customer applying for a business loan. Instead of waiting days for approval and receiving a generic letter, they receive a beautifully branded, personalized offer within minutes of submission. Thats the kind of experience that builds loyalty and earns referrals.

The Future: AI-Driven Document Automation

The next evolution in document generation includes artificial intelligence and machine learning. These capabilities enable:

-

Smart content recommendations based on customer profiles

-

Predictive document personalization

-

Automated analysis of customer interactions to improve future communications

As AI advances, expect document generation to become even more responsive and intelligent, further enhancing customer experience across financial services.

Conclusion

In the high-stakes world of finance, customer experience is everything. Document generation software is a game-changer, offering the speed, accuracy, and personalization modern clients expect. By automating and optimizing this vital part of the customer journey, financial institutions can stand out in a crowded marketplace and build lasting client relationships.

Now more than ever, investing in the right document generation tools is not just an operational upgradeits a strategic advantage.